The NASDAQ Composite Index is one of the most closely watched stock market indices, serving as a barometer of the technology sector and the broader market trends. Its importance to investors, analysts, and the global economy cannot be overstated. In this comprehensive article, we will delve into the latest developments, historical insights, and actionable data concerning the NASDAQ Composite Index.

What is the NASDAQ Composite Index?

The NASDAQ Composite Index represents the performance of all common stocks and similar securities listed on the NASDAQ Stock Market. Unlike the Dow Jones Industrial Average, which tracks only 30 companies, or the S&P 500, which focuses on 500 large-cap stocks, the NASDAQ Composite includes over 3,700 companies. Its breadth makes it a comprehensive indicator of market sentiment, particularly in the technology sector.

The index includes companies from a variety of industries, but it is heavily weighted toward technology, biotechnology, and telecommunications. Major components include companies like Apple, Microsoft, Amazon, Tesla, and Alphabet (Google).

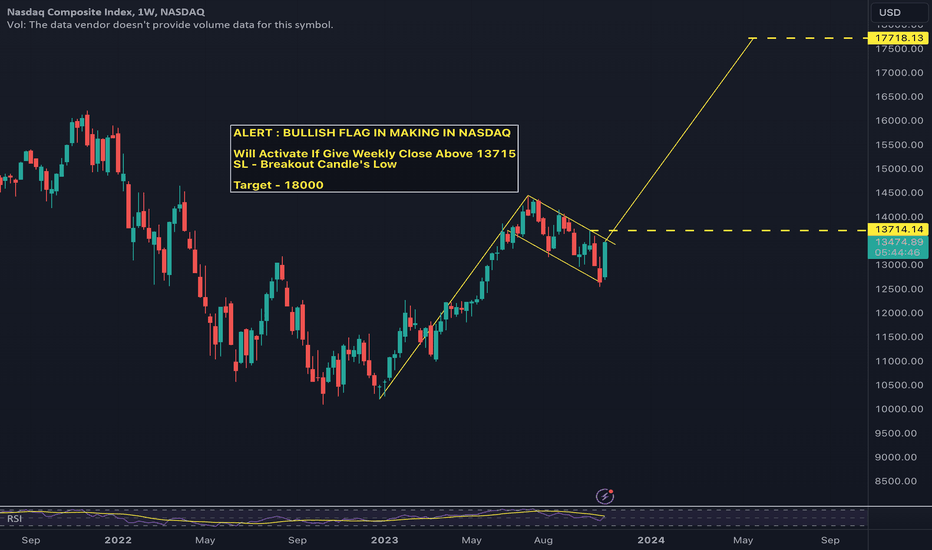

Latest Performance Trends of the NASDAQ Composite Index

Performance in 2024

As of the latest data, the NASDAQ Composite Index has demonstrated resilience amid global economic challenges. Despite concerns about inflation, interest rate hikes, and geopolitical tensions, the tech-heavy index has shown strong growth, fueled by advancements in artificial intelligence (AI), cloud computing, and renewable energy technologies.

Key Metrics

-

Current Value: As of [Insert Date], the NASDAQ Composite Index stands at approximately [Insert Value].

-

Year-to-Date Growth: The index has risen by X% in 2024, outpacing many other major indices.

-

Sector Contribution: The technology sector accounts for over 50% of the index’s weighting, with AI-driven companies contributing significantly to its recent surge.

Factors Influencing the NASDAQ Composite Index

Technological Innovations

Technology remains the backbone of the NASDAQ Composite Index. Breakthroughs in areas such as AI, 5G, quantum computing, and green energy have driven investor interest, pushing the index higher.

Interest Rates and Inflation

The Federal Reserve’s monetary policies play a crucial role in the index’s performance. Lower interest rates generally benefit high-growth tech companies, enabling them to secure cheap funding for innovation and expansion.

Earnings Reports

Quarterly earnings reports from NASDAQ-listed giants like Meta, NVIDIA, and Tesla significantly influence the index. Strong earnings often lead to upward momentum, while disappointing results can trigger declines.

Geopolitical Events

Events such as trade wars, sanctions, or political instability have varying effects on the NASDAQ Composite. Tech companies, often reliant on global supply chains, are particularly sensitive to these disruptions.

Historical Performance of the NASDAQ Composite Index

Dot-Com Boom and Bust

The late 1990s saw the NASDAQ Composite surge during the dot-com bubble, reaching a peak of 5,048.62 in March 2000. However, the subsequent crash wiped out trillions of dollars in market value.

Post-2008 Financial Crisis Recovery

Following the 2008 financial crisis, the index began a prolonged recovery, driven by the rise of tech giants like Apple and Amazon. By 2020, the NASDAQ Composite had crossed the 10,000 mark, a historic milestone.

COVID-19 Pandemic

The pandemic accelerated the adoption of digital technologies, propelling the NASDAQ Composite to new highs. By the end of 2021, it had surpassed 16,000 points, reflecting the dominance of technology in a post-pandemic world.

Major Companies Driving the NASDAQ Composite

Apple Inc. (AAPL)

Apple remains a cornerstone of the NASDAQ Composite, contributing significantly to its market capitalization. Recent product launches, including advances in AI-driven services, have solidified its leadership.

Microsoft Corporation (MSFT)

Microsoft’s cloud computing platform, Azure, and its ventures into AI technologies make it a key driver of the index’s performance.

NVIDIA Corporation (NVDA)

As a leader in graphics processing units (GPUs), NVIDIA has seen exponential growth thanks to the rise of AI and gaming technologies.

Tesla Inc. (TSLA)

Tesla’s focus on electric vehicles (EVs) and sustainable energy continues to attract investors, reinforcing its role in the NASDAQ Composite’s tech-heavy weighting.

How to Invest in the NASDAQ Composite Index

Direct Investment in ETFs

Investors can gain exposure to the NASDAQ Composite through Exchange-Traded Funds (ETFs) such as the Invesco QQQ ETF (QQQ), which tracks the NASDAQ-100 subset of the index.

Stock Picking

For those looking for higher returns, directly investing in leading NASDAQ-listed stocks like Alphabet or Amazon may be a viable strategy.

Diversification

Diversifying your portfolio by investing in sectors beyond technology can mitigate risks associated with market volatility.

Future Outlook for the NASDAQ Composite Index

Growth Opportunities

The future of the NASDAQ Composite is bright, with emerging technologies such as AI, IoT (Internet of Things), and renewable energy poised to drive growth.

Challenges Ahead

Economic factors like inflation and regulatory pressures on tech companies may pose challenges. However, the index’s adaptability and innovation-driven focus suggest resilience.

Key Takeaways

The NASDAQ Composite Index remains a critical benchmark for understanding market trends, especially in the technology sector. By staying informed about its latest movements, historical context, and future prospects, investors can make better decisions to optimize their portfolios.